Comprehensive Auto Insurance Are you in the market for auto insurance coverage that truly has your back? Look no further than comprehensive coverage – the superhero of protection for your vehicle! In this blog post, we will dive into the world of auto insurance coverage comparison, specifically focusing on comprehensive coverage. Get ready to learn about the types of coverage available, understand the benefits it offers, and discover tips for choosing the right policy. Let’s buckle up and explore all things comprehensive auto insurance together!

What is Auto Insurance Coverage?

Auto insurance coverage is like a safety net for your vehicle, providing financial protection in case of unexpected events. It is a contract between you and the insurance company that helps cover costs related to accidents, theft, or damage to your car. Different types of coverage are available to suit varying needs and budgets.

Liability coverage is essential and typically required by law, as it helps pay for damages you cause to others in an accident. Collision coverage takes care of repairs or replacement costs if your vehicle gets damaged in a collision with another vehicle or object. Comprehensive coverage goes beyond collisions, covering damages from theft, vandalism, natural disasters, and more.

Understanding the various types of auto insurance coverage ensures you have the right level of protection when hitting the road.

Types of Auto Insurance Coverage

When it comes to auto insurance coverage, there are several types available to choose from. The most common ones include liability coverage, which is mandatory in most states and helps cover costs if you’re at fault in an accident. Then there’s collision coverage, which helps pay for repairs to your vehicle after a crash.

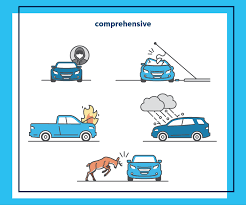

Another essential type of auto insurance coverage is comprehensive coverage. This type of policy protects you against damages not caused by a collision, such as theft, vandalism, or natural disasters like hail or floods. It provides peace of mind knowing that your vehicle is protected from various risks beyond just accidents on the road.

Additionally, there’s uninsured/underinsured motorist coverage that steps in if you’re involved in an accident with a driver who doesn’t have sufficient insurance to cover the damages. Personal injury protection (PIP) is also worth considering as it covers medical expenses for you and your passengers regardless of who was at fault in an accident.

Understanding the different types of auto insurance coverage options available can help you make informed decisions about protecting yourself and your vehicle on the road.

Comprehensive vs. Collision Coverage

When it comes to auto insurance coverage, understanding the difference between comprehensive and collision coverage is crucial. Comprehensive coverage protects your vehicle from non-accident-related incidents like theft, vandalism, or natural disasters. On the other hand, collision coverage specifically covers damages resulting from accidents with other vehicles or objects.

Comprehensive coverage provides a broader level of protection for your car beyond just collisions on the road. It offers peace of mind knowing that you’re covered in various scenarios that could damage your vehicle. Collision coverage focuses solely on accidents involving your vehicle and another object.

While collision coverage may be more straightforward since it pertains to accidents, comprehensive coverage offers a wider range of protection against different risks. Depending on your needs and budget, you can choose one or both types of coverage to ensure adequate protection for your vehicle.

Benefits of Comprehensive Coverage

Comprehensive coverage offers a wide range of benefits that can provide you with peace of mind on the road. This type of insurance protects your vehicle from non-collision related incidents like theft, vandalism, natural disasters, and falling objects. With comprehensive coverage, you can rest assured that your car is protected in various unforeseen circumstances.

One significant benefit of comprehensive coverage is financial security. If your car is damaged or stolen, the insurance company will help cover the costs of repairs or replacement, saving you from unexpected expenses. Additionally, having comprehensive coverage can also protect your investment in the vehicle by ensuring its value is maintained over time.

Moreover, comprehensive coverage often includes benefits such as rental car reimbursement and roadside assistance services in case of emergencies while traveling. These extra perks can be invaluable during stressful situations on the road. Investing in comprehensive coverage can offer extensive protection for your vehicle beyond just accidents alone.

Factors that Affect Comprehensive Coverage Rates

When it comes to determining the rates for comprehensive coverage, several factors come into play. One significant factor is the value of your vehicle; the more expensive your car, the higher your premium might be. Additionally, where you live can impact your rates as well. Urban areas with higher crime rates may lead to increased premiums compared to rural regions.

Your driving record also plays a crucial role in influencing comprehensive coverage rates. If you have a history of accidents or traffic violations, insurers may consider you a higher risk and adjust your premium accordingly. The deductible amount you choose can affect your rates too. Opting for a lower deductible typically means higher premiums but less out-of-pocket expenses in case of a claim.

Furthermore, the safety features of your vehicle can impact comprehensive coverage rates – vehicles equipped with advanced safety technology may qualify for discounts. Insurance companies will also consider factors like age and gender when calculating premiums for comprehensive coverage policies.

Tips for Choosing the Right Comprehensive Coverage Policy

When it comes to choosing the right comprehensive coverage policy for your car, there are a few key tips to keep in mind.

Assess your needs and consider the value of your vehicle. If you have a newer or more expensive car, investing in comprehensive coverage may be worth it to protect your investment.

Next, compare quotes from different insurance providers to ensure you’re getting the best deal. Don’t forget to look at the coverage limits and deductibles offered by each policy.

Additionally, check for any additional benefits or perks that come with certain comprehensive coverage plans, such as roadside assistance or rental car reimbursement.

It’s also recommended to review customer reviews and ratings of insurance companies before making a decision. A good reputation for customer service can make all the difference when filing a claim.

Don’t hesitate to ask questions and clarify any doubts with your insurance agent before finalizing your comprehensive coverage policy. Your peace of mind is worth taking the time to choose wisely!

Comparison of Top Auto Insurance Providers for Comprehensive Coverage

When it comes to choosing the right comprehensive auto insurance coverage, comparing different providers is key. Each insurance company offers varying levels of coverage and pricing, so it’s essential to do your research.

One top provider to consider is State Farm, known for its excellent customer service and extensive network of agents across the country. Another option is Geico, which is recognized for its competitive rates and user-friendly online platform.

Progressive is also a popular choice due to its innovative tools like Snapshot that can help lower premiums based on driving habits. Allstate stands out for its customizable policies and diverse range of coverage options.

Make sure to compare quotes from multiple providers before making a decision. Finding the right comprehensive coverage will depend on your individual needs and budget.

Conclusion

After comparing the top auto insurance providers for comprehensive coverage and considering all the factors that affect rates, you are now equipped with valuable information to make an informed decision. Remember to assess your needs, budget, and preferences before selecting a policy. By choosing the right comprehensive coverage, you can enjoy peace of mind knowing that your vehicle is protected from a wide range of risks. Stay safe on the road!